|

|

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Struggling with tax debt can feel like an endless storm, but with our expert tax debt attorneys by your side, you can chart a course to calmer waters, settle your tax debt, and regain control of your financial future-our seasoned professionals offer unparalleled guidance and a personalized strategy to navigate the complexities of tax regulations, transforming daunting challenges into manageable solutions, so you can breathe easy knowing that your tax issues are being handled with precision, expertise, and unwavering commitment to your peace of mind.

https://www.natptax.com/EventsAndEducation/Pages/OW-Tax-Debts.aspx?srsltid=AfmBOoqHG4zKdastsY8hMNUtAjPBKgZ9STcb8ZaJvVgUXzAJfMrbPnQT

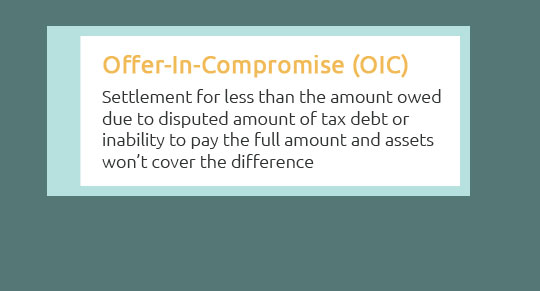

This workshop includes presentation slides, case studies, forms, letters, checklists, and access to the workshop recording. https://www.myirstaxrelief.com/back-tax-help/tax-debt-relief-services/offer-in-compromise-oic-overview/

An offer in compromise is an agreement between a taxpayer and the IRS that resolves the taxpayer's tax debt. The IRS has the authority to settle, or ... https://www.hrblock.com/tax-center/irs/audits-and-tax-notices/owe-the-irs-back-taxes/?srsltid=AfmBOoojrbHj7PrutV1vu7NTsel3yAmazMvwgyrsehNphNNcTMLAnHqS

You can pay through payroll deductions (Form 2159, Payroll Deduction Agreement). Related: Does an installment plan or IRS debt show up on a credit report? Find ...

|